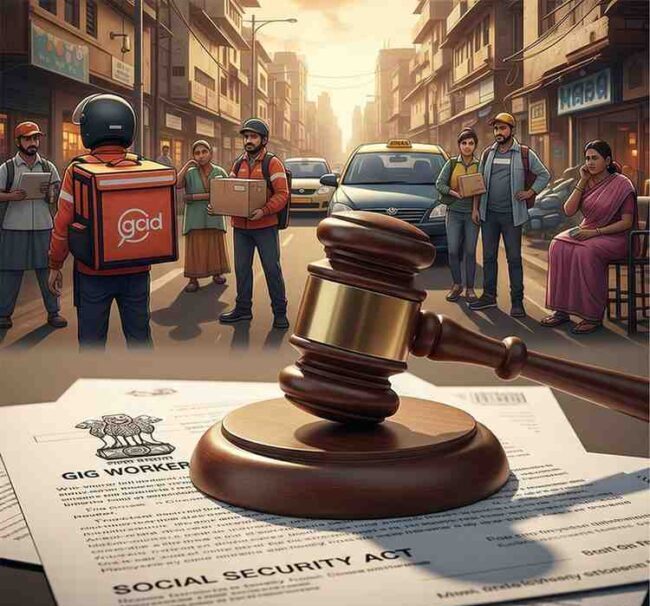

Gig Workers and Indian Law: Rights, Legal Framework & State-Level Reforms

Understand who gig workers are, their legal status in India, central laws like the Code on Social Security, and which Indian states have introduced welfare laws, including Rajasthan’s landmark Gig Workers Act.

Gig Workers and Indian Law: Rights, Legal Framework & State-Level Reforms

The gig economy has become an integral part of India’s employment landscape, especially with the rise of digital platforms like Swiggy, Zomato, Ola, Urban Company, and Amazon. These platforms rely on gig workers — individuals who work on short-term contracts, often without traditional job security. But as this workforce grows, so does the demand for better protections. This article explores who gig workers are, what Indian law says about them, and which states have introduced welfare laws to support them.

Who Are Gig Workers?

Individuals who perform temporary or flexible jobs using online platforms are known as gig workers. Unlike traditional full-time employees, they don’t have fixed hours, permanent contracts, or employer-provided benefits.

Examples include:

- Food delivery riders (Swiggy, Zomato)

- Cab drivers (Ola, Uber)

- Freelancers and home service providers (Urban Company)

- E-commerce delivery agents (Amazon, Flipkart)

Gig work offers flexibility and independence — but often at the cost of job security, social security, and labor protections.

Indian Law on Gig Workers: A New Legal Category

Earlier, Indian labor laws did not recognize gig workers as a distinct category. However, that changed with the introduction of the Code on Social Security, 2020, passed by the Central Government.

Essential Provisions Laid Out in the Code on Social Security, 2020″

- Gig workers are individuals who earn income through work arrangements that do not follow the conventional employer-employee structure.

- Introduces a new category: platform workers.

- Recommends establishing social security programs specifically for gig and platform-based workers.

- Mandates the central and state governments to register gig workers and create welfare boards or schemes.

- Allows the collection of a social security fund, partially funded by platform companies.

Although promising, implementation is still pending at the national level. This has led some proactive states to step in.

Which Government Makes Law on Gig Workers in India?

India follows a federal structure, and labor is part of the Concurrent List, meaning both the Central and State Governments can make laws on it.

- “The Central Government develops comprehensive policies and laws, including the Code on Social Security, 2020.

- State Governments can implement, modify, or introduce their laws to suit local needs.

States That Have Introduced Gig Worker Welfare Laws and Schemes

Rajasthan – First State to Pass a Gig Workers Act

“The Government of Rajasthan passed the Platform-Based Gig Workers (Registration and Welfare) Act in 2023.

Rajasthan became the first state in India to pass a dedicated law for gig and platform workers.

Key Provisions:

- Creation of a Gig Workers Welfare Board.

- Mandatory registration of all gig/platform workers and companies operating in the state.

- Introduction of a Welfare Fund to be financed by contributions from platforms (e.g., 1-2% of company revenue).

- Provision of healthcare, insurance, pensions, and financial aid through the fund.

This law is a landmark reform and could serve as a model for other states.

Karnataka – Announced Gig Worker Welfare Schemes

While Karnataka has not yet passed a specific law, the state’s 2023–24 Budget included several welfare proposals for gig workers:

- Creation of a Gig Workers Welfare Board

- Financial assistance during emergencies

- Access to insurance and healthcare

- Skill development and support services

These initiatives aim to support Bengaluru’s large platform workforce.

Delhi – Policy Initiatives in Progress

Delhi has proposed a gig worker welfare policy, including:

- Registration portals for all platform workers in the NCR region.

- Plans for accident insurance, health cover, and other protections.

- Involvement of platform companies in funding schemes.

While still in the planning phase, Delhi is expected to formalize these ideas soon.

Maharashtra – Health Insurance and Registration Initiatives

Maharashtra has proposed:

- Group health insurance schemes for gig workers.

- State-supported registration drives.

- Financial support for work-related accidents.

Although not yet codified into law, these efforts aim to expand protections for gig workers across Mumbai and Pune.

Challenges Faced by Gig Workers in India

Despite legal progress, gig workers still face:

- No minimum wage guarantee

- Lack of job security and benefits

- No clear access to grievance redressal

- Algorithm-based work allocation, leading to uncertain earnings

- Limited awareness of their rights and legal status

Conclusion: The Road Ahead

It’s clear that the gig economy is more than a trend — it’s the direction work is heading. While the Central Government’s Code on Social Security has laid the foundation, states like Rajasthan have taken bold steps to fill the legal gaps.

For India’s 7.7+ million gig workers, the journey toward dignity, fairness, and legal protection has begun — but much work remains. Effective implementation, cooperation between platforms and governments, and raising worker awareness will be key to building an inclusive and equitable gig economy.