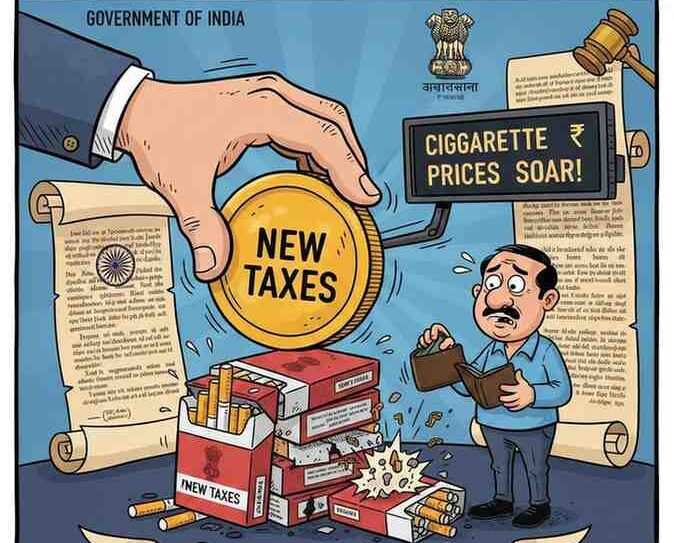

India will impose a new excise duty on cigarettes from 1 February 2026 under the Central Excise (Amendment) Bill, 2025. Find out about the duty structure, the legislation itself, how it affects prices and consumers, what manufacturers think, and where public health comes into play.

Introduction

In a major step to promote public health and increase revenue generation, India has reaffirmed a levy of specific excise duty on cigarettes from February 1, 2026. This move comes after Parliament recently passed the Central Excise (Amendment) Bill, 2025, to expand its collection of duties on tobacco products beyond the GST-only regime.

Cigarettes The new excise duty, which is ₹2,050 to ₹8,500 per 1,000 sticks, is over and above the prevailing 40% Goods and Services Tax. This two-tier structure of taxation is likely to significantly raise the prices of cigarettes, thus affecting consumer behavior, industry economics, and public health consequences.

This piece unpacks the legal underpinnings, the mechanics of taxing, why it is being done, and its wider consequences—clearly, without meandering, with zero copy-pasting.

Legal Background: Central Excise (Amendment) Bill, 2025

Before the introduction of GST in 2017, excise duty was levied along with state-level VAT. By the introduction of GST, most indirect taxes were brought under its fold, except tobacco products, which still attracted several cesses and additional levies.

The Central Excise (Amendment) Bill, 2025, reintroduces an excise duty-based cigarette tax regime that authorizes the central government to levy fixed-rate duties on cigarettes based on their length, filter variety, and packaging format.

Key Legal Objectives

- Enhancement of the government’s ability to control tobacco through fiscal instruments

- Bring India’s tax policy in line with global tobacco control obligations

- Develop an income stream that is stable, predictable, and not reliant on the collection of GST

New Excise Duty Formulation

The excise is not based on value – it is levied on a per 1,000 stick basis regardless of price.

Indicative Duty Slabs

- Subsequent Slab: ₹2,050 per 1,000 cigarettes

- Higher Slab: ₹8,500 per 1,000 cigarettes

The exact rate depends on:

- Cigarette length (short, medium, long)

- Presence or absence of filters

- Category under the notified rules

Such excise tax is payable in addition to:

- 40% GST

- Any applicable compensation cess

Why the Duty Was Implemented by the Government

Public Health Policy

Tobacco in the form of smoking is still one of the major contributory causes to preventable death in India. Increased taxation is a well-established global tool in decreasing tobacco use, specifically by:

- Youth

- First-time users

- Low-income groups

Revenue Generation

The exchequer is heavily dependent on tobacco taxes. A specific excise duty ensures:

- Solid income, whether the price is artificially high or not

- Less Tax Hiding Through Lower Reporting of The Retail Prices

Global Commitments

India is a party to the WHO Framework Convention on Tobacco Control (FCTC), which includes fiscal measures as part of its recommendations for member states to adopt taxation as a tool to reduce tobacco use.

Impact on Cigarette Prices

Retail prices are likely to go up sharply—GST would be levied on top of excise duty.

Likely Outcomes

- Leading cigarette brands could become costlier by 10-25%

- Premium names may face even larger hikes

- Manufacturers can transfer the full tax to consumers

Cigarette demand is price elastic, so even modest increases have equivalently large impacts in terms of consumption.

Impact on Consumers

Short-Term Impact

- The heavy burden of the cost on daily smokers

- Potential substitution with less expensive or illegal alternatives

Long-Term Impact

- Reduced smoking rates

- Reduced expenditure on healthcare for tobacco-attributable diseases

- Attitude change for young and occasional smokers

Impact on Cigarette Manufacturers

Significant domestic cigarette manufacturers will be required to:

- Pay a higher tax incidence per unit

- Face potential decline in sales volumes

- Endure pressure on profit margins

Industry Response May Include:

- Absorbing part of the tax to stay competitive

- Restructuring product sizes and packaging

- Diversifying into non-tobacco segments

But firms with strong pricing power can sustain profits even on lower volumes.

Economic and Social Implications

Positive Effects

- Improved public health outcomes

- Reduction in tobacco-related mortality

- More government money to health programs

Challenges

- Threat of an increase in the illicit cigarette trade

- Enforcement difficulties in rural areas and near the border

- Effect on tobacco growers and ancillary trades

Enforcement and anti-smuggling will therefore be the driver of the policy.

Comparison with Global Practices

Most governments use a mixed tax system, which includes:

- Specific excise duty (per unit)

- Ad valorem (percentage of value) approach to tax

India’s move brings it in line with best practices observed elsewhere in the UK, Australia, and some EU countries, among which high taxes on tobacco use are a successful means of driving down smoking rates.

Conclusion:

The creation of a new excise tax on cigarettes, beginning in February 2026, represents a significant shift for India’s tobacco taxes. By integrating excise duty with GST, the government has not only demonstrated its commitment to public health but also devised a strong revenue-raising tool.

While the short-term transition to alternative products may present challenges for consumers and producers, their ultimate impact—lower smoking rates, better health results, and reduced healthcare costs—is consistent with India’s larger social and economic goals. The proof will be in enforcement and in reconciling health goals with economic reality.

This policy may be a game-changer for India’s tobacco control program over the next decade if it is implemented well.

Frequently Asked Questions (FAQs) on the New Excise Duty on Cigarettes in India

When will the new excise tax on cigarettes take effect?

The increased excise tax rate applies as of 1 February 2026.

Is GST levied on top of this excise duty?

Yes. The excise duty is separate from the prevailing 40% GST in place and any applicable cess.

How much is the excise duty on cigarettes?

Based on product categorization, the duty varies between ₹2,050 and ₹8,500 per 1,000 cigarettes.

Why is the government raising taxes on cigarettes?

The primary reasons are:

-Reducing tobacco consumption

-Improving public health

-Increasing government revenue

-Meeting international health commitments.