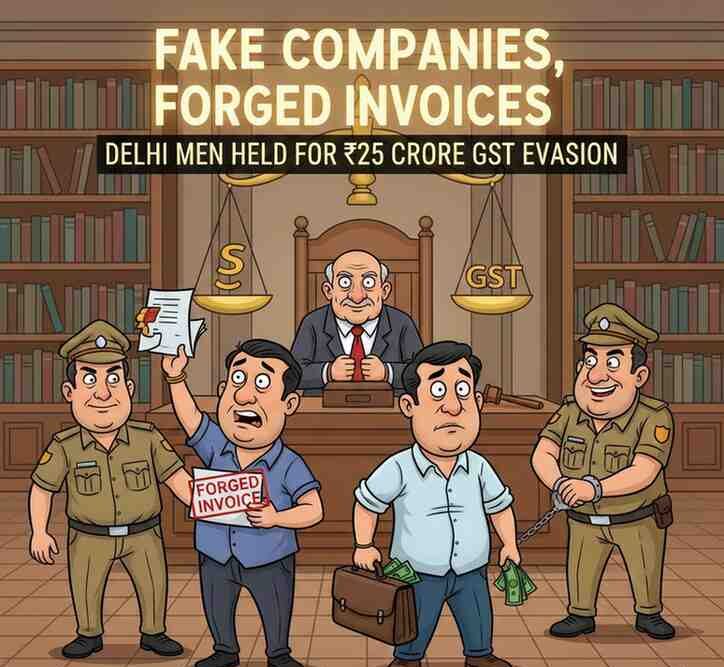

Two Delhi-based men have been arrested for evading ₹25 crore worth of Goods and Services Tax (GST) by fabricating companies and generating forged invoices. The matter relates to “serious offences” under the Bharatiya Nyaya Sanhita (BNS) and the GST laws, with investigators looking at a larger network of tax fraud.

Introduction

In a massive strike against tax fraud, the state law enforcement agencies arrested two Delhi-based men for their suspected role in a ₹25 crore racket of GST evasion. The accused are believed to have made shell firms and bogus invoices to avail ITC fraudulently, causing a huge loss to the government exchequer.

The arrests underscore the government’s accelerated drive to crack down on GST fraud and ensure accountability under India’s emerging criminal laws, like Bharatiya Nyaya Sanhita (BNS).

What Is the Case About?

Allegations Against the Accused, as Per Investigating Agencies:

- Created phantom or ghost firms or real but fake-fronted businesses

- Supplied fake invoices (GST) without the actual supply of goods/services

- ITC was fraudulently availed of by them

- Layered transactions in phantom names to disguise ownership and transaction parties

The total GST evasion is pegged at ₹25 crore, making it a high-value economic offence.

How the GST Evasion Was Done

Use of Fake Companies

The accused are said to have registered companies under:

- Bogus addresses

- Stolen or misused identity documents

- Dummy directors

These companies were shell companies having no business in reality.

Forged Invoices and ITC Claims

Fake invoices were generated to:

- Show false purchases and sales

- Artificially inflate turnover

- ITC claimed without paying tax

This effectively allowed the defendants to commit tax evasion or claim false refunds.

Legal Charges and Laws Invoked

Under the GST Law

The accused have also been charged under sections of the CGST Act, 2017, dealing with:

- Issuing invoices without supplies

- Wrongful availing of ITC

- Tax evasion exceeding the prescribed limits

If the evasion amount crosses the statutory threshold, these are both non-bailable and cognizable offenses.

Under Bharatiya Nyaya Sanhita (BNS)

Criminal charges also lodged against the defendants include:

- Cheating

- Forgery

- Criminal conspiracy

The BNS replaced the Indian Penal Code (IPC) and imposed stricter definitions and punishments for economic offences or white-collar crimes.

Larger Fraud Network Under Scrutiny

Police suspect the accused are part of a larger GST fraud racket across some states. Investigators are now:

- Tracing money trails

- Examining linked firms and beneficiaries

- Identifying brokers and accountants involved

- Cross-checking GST registrations with similar patterns

More arrests and seizures of assets are expected as the investigation widens.

Government’s Stand on GST Fraud

The GST wing has reiterated:

- False invoicing is a serious economic crime

- Technology-driven surveillance systems are already monitoring suspect transactions

- Strict penalties will be imposed to deter violations

This case sends a clear message to those engaging in criminal tax activity—no one is above the law.

Impact of the Case

For Businesses

- Increased scrutiny of GST compliance

- Greater risk for shell companies and fake registrations

- Focus on proper documentation and genuine transactions

For the Economy

- Protection of government revenue

- Strengthening trust in the GST system

- Crackdown on the parallel economy

Conclusion

The arrest of two Delhi-based men for allegedly evading ₹25 crore in GST is another major step in India’s battle against financial crimes. By invoking both the GST Act and the Bharatiya Nyaya Sanhita, authorities have made it clear that tax fraud will not be tolerated. As investigations progress, this case may expose a wider web of economic offenders and trigger further enforcement actions.

Frequently Asked Questions (FAQs): Fake companies, forged invoices: Delhi men held for ₹25 crore GST evasion

1. What is GST evasion?

GST evasion refers to illegally avoiding the payment of Goods and Services Tax through fake invoicing, false ITC claims, or under-reporting turnover.

What is Input Tax Credit (ITC)?

ITC allows businesses to deduct the tax paid on inputs from the tax payable on outputs. Claiming ITC without real transactions is illegal.

Why is fake invoicing a serious offence?

Fake invoicing causes heavy revenue loss to the government and undermines fair market competition.

What action can be taken against GST evaders?

Penalties can include:

Heavy fines

Imprisonment

Cancellation of GST registration

Attachment of property